How does the LTC Partnership Program work?

A Partnership qualified policy provides the purchaser the right to apply for Medicaid under modified eligibility rules that include a special feature know as an "asset disregard." This feature allows you to keep assets that normally would not be allowed if you need to apply for and qualify for Medicaid's LTC services. The amount of assets that Medicaid will disregard is proportional to the benefits that your LTC Insurance Policy provides. These policies must include an inflation rider that increases your daily benefit based on a preset percentage. With this in place, you can actually protect more of your assets each year as the policy grows. If you have a Partnership-Qualified LTC Insurance Policy and receive $150,000 in benefits, you can apply for Medicaid as those funds are depleted and, if eligible, retain $150,000 worth of your assets over and above your state's Medicaid asset threshold. Most states have a threshold of only $2,000 for a single person.

An Example:

Mike is a single male, purchases a Partnership Qualified Policy with a value of $100,000. A number of years later he needs to use the policy and receives benefits in the policy after the inflation rider increase of $150,000. At some point Mike either runs out of the funds or needs another LTC event stay. If Mike's policy was not a Partnership-Qualified policy, in order to qualify for Medicaid he would only be entitled to keep $2,000 in assets. He would have to spend down any and all assets over and above this amount. However, because Mike bought a Partnership-Qualified policy he can now keep $152,000 in assets and the state will not recover those funds after his death. Those assets will go to his family or charities set up in his will. However, any assets over $152,000 will have to be spent in order for him to be eligible for Medicaid. He will also have to satisfy income and other requirements for Medicaid before he can qualify.

Some Important Considerations:

• Not all LTC policies are Partnership-Qualified! Make sure you contact a professional advisor when selecting a plan.

• Policies issued before the Partnership's effective date are not qualified, however you might be able to exchange them.

• It is important that you know that eligibility for Medicaid is not automatic. LTC Medicaid services vary in each state.

• States offer "reciprocity" with each other and honor the disregard from the other state, but this can change at any time.

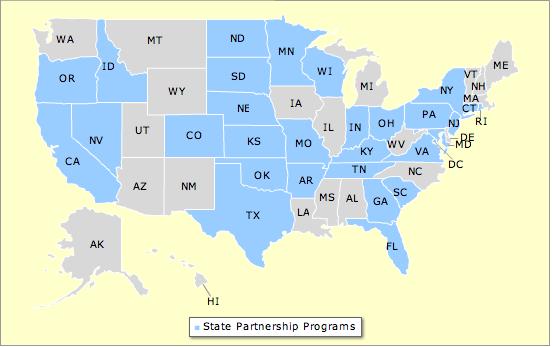

Which sates have the Partnership Program?

See the graphic below to see if your state is participating in the program. Contact us to talk about a plan right for you.

|